The Definitive Guide to Regulatory Compliance Software

Regardless of the sector or size, all companies must follow specific rules and regulations as part of their operations. Any violation of this regulation will likely result in legal repercussions such as federal penalties.

In this blog post, you’ll learn all there is to know about regulatory compliance, and how custom Regtech software can help you to overcome the most common challenges in your industry.

What is Regulatory Compliance

Regulatory compliance refers to an organization’s set of policies and processes that promote adherence to laws, rules, and requirements, enacted by the authorities in the jurisdiction where the company operates. Organizations that default face charges as set aside by the state law.

With the regulatory environment constantly changing, businesses have only one solution: to remain compliant at all costs. Business owners must learn how to adapt whenever they notice these changes, otherwise, they put their companies at risk.

What are Examples of Regulatory Compliance

We can point to a variety of regulatory requirements that impact most corporations operating in the US, such as:

- The Dodd-Frank Act—It restricts the investment activities of some banks, limiting speculative trading and requiring some banks to increase their reserve requirements.

- The Sarbanes-Oxley Act (SOX)—This act creates regulatory obligations for how corporations certify their financial reports, how internal controls and reporting methods are established by financial auditors, and corporate record-keeping.

- The Health Insurance Portability and Accountability Act (HIPAA)—It was created to safeguard the data and interests of people covered through health insurance and governs the storage and privacy of their personal medical information and data.

- The GDPR—It creates regulatory compliance requirements for corporations that collect data from citizens of the EU.

What Are the Consequences of Non-compliance in Regulatory Compliance

Non-compliance arises when the business fails to comply with applicable laws and regulatory obligations. An increasing number of companies are prioritizing compliance activities and risk management as key strategic requirements. According to the State of the Compliance Survey Report, 2021, 64% of organizations intend to focus on enhancing regulatory risk and compliance assessments.

Non-compliance and lapses in regulatory compliance can lead to:

Penalties

The penalties for non-compliance are often running into millions of dollars. For example, the fine framework in GDPR can reach a maximum of €20 million or 4% of annual global turnover.

Business Disruption

Non-compliance could result in the business being suspended or even debarred from bidding on government contracts. Lawsuits and legal actions can disrupt the company’s operations and may generate additional money losses. In extreme cases, the entire company might be shut down.

Reputation Losses

Non-compliant businesses damage their reputation as an ethical consumer and employer brand. Businesses can suffer a loss of reputation among clients, business partners, and the public due to negative publicity in the media.

Revenue Losses

The resulting loss of customer confidence and decreased customer churn can lead to a loss in revenues in the long term.

Challenges That Come With Regulatory Compliance

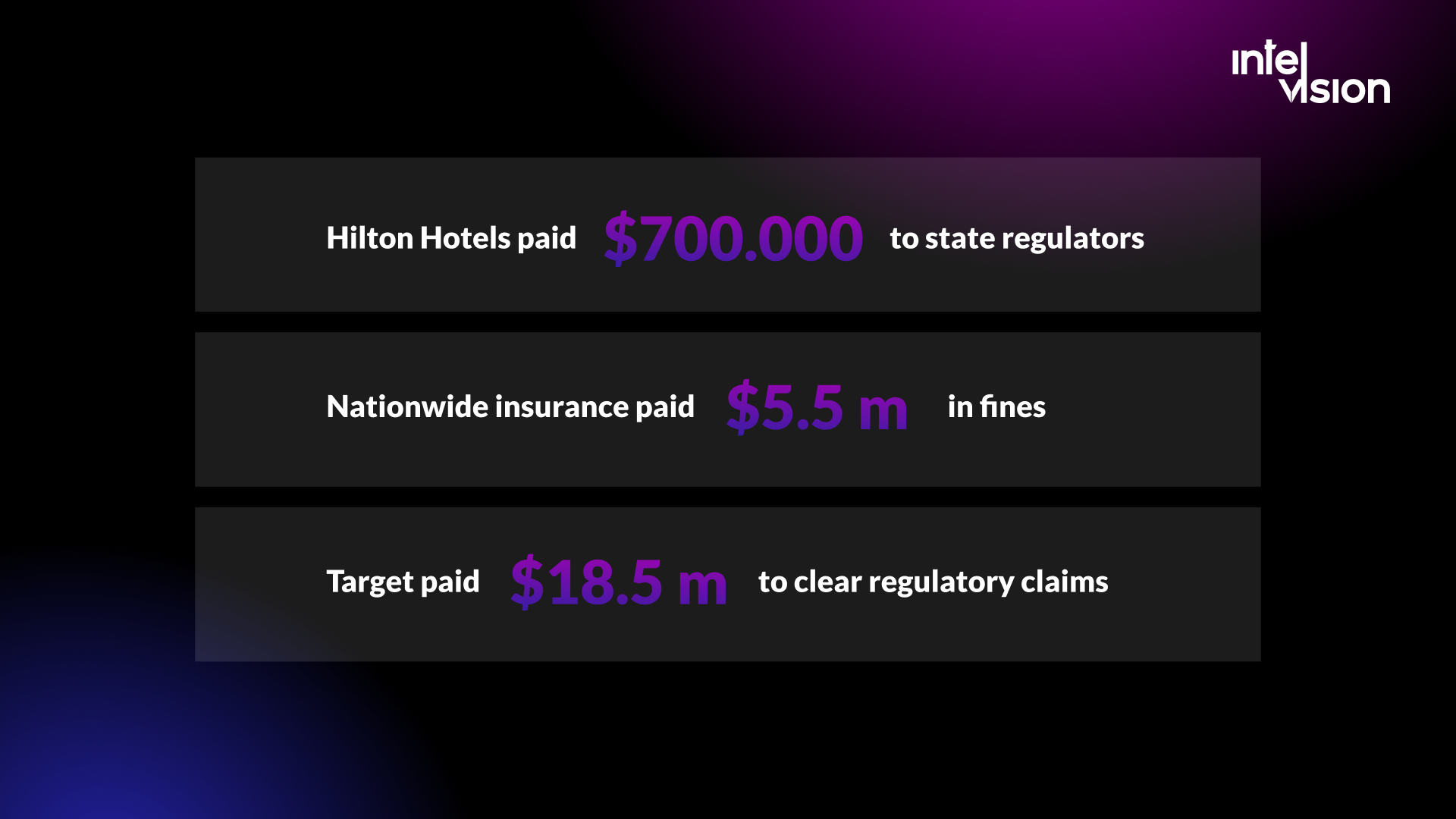

Staying compliant with regulations can be challenging even for large international companies. For example, Hilton Hotels paid $700.000 to state regulators, nationwide insurance paid $5.5 million in fines, and Target $18.5 million to clear regulatory claims.

Being aware of all the challenges helps you prepare for and mitigate any future misfortunes. Nowadays, the compliance requirements are so overwhelming, and staying compliant takes a lot of investment in resources, human capacity development, and keeping up to date on constantly changing regulations. Below we have explained how Regtech software developed by a reliable software provider can make all the work in this area twice easier.

How to Control the Compliance Risks

Start with the implementation of compliance control in the company.

- Hire or appoint an employee responsible for risk management (for example, lawyers or consulting).

- Develop risk management solutions.

- Implement a compliance program and practices. Familiarize each employee and company representative with them.

- Eliminate all non-compliance situations. Monitor violations and respond to them.

- Carry out regular inspections, monitor all applicable laws, and keep knowledge up to date.

The concept of compliance covers different directions depending on the industry: investment compliance, tax compliance, principles of fair treatment of clients, and other industry-specific regulations. Therefore, each company can implement additional processes, thus creating its unique structure of compliance control.

Examples of Compliance Control Program Implementation

After the 2008 corruption scandal, the Siemens company created rules that should minimize the likelihood of a repeat of the situation. The motto: “Only clean business is Siemens business” emphasizes the lack of tolerance for corruption and violations of competition rules. The corporation has developed internal documents that are valid for all divisions and suppliers. The company publishes annual reports on its official website.

The company “MTS” can be cited as an example of compliance control in the CIS. After listing on the New York Stock Exchange, it had to implement strict compliance controls. The company provides reporting to the Securities and Exchange Commission, as well as under the anti-corruption legislation of the US (Foreign Corrupt Practices Act 1977) and the UK (UK Bribery Act 2010). Even in contracts with employees, compliance requirements are prescribed, and in contracts with business partners—compliance agreements and business partner policies for monitoring compliance with the norms of anti-corruption legislation. After all, if counterparties are involved in corruption scandals, it can harm the company itself.

How to Leverage Custom Regtech Software for Profitability

The global Regtech and market size is expected to grow from USD 7.6 billion in 2021 to USD 19.5 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 20.8% during the forecast period. Big data, cloud computing, and ML algorithms are being used to heavily regulate businesses through computerized risk management procedures.

Regulatory compliance management software comes in the form of a program, technology, or tool used by organizations to keep track, monitor, and audit their business dealings. Using regtech software, companies can determine whether they meet compliance standards relevant to their specific industry.

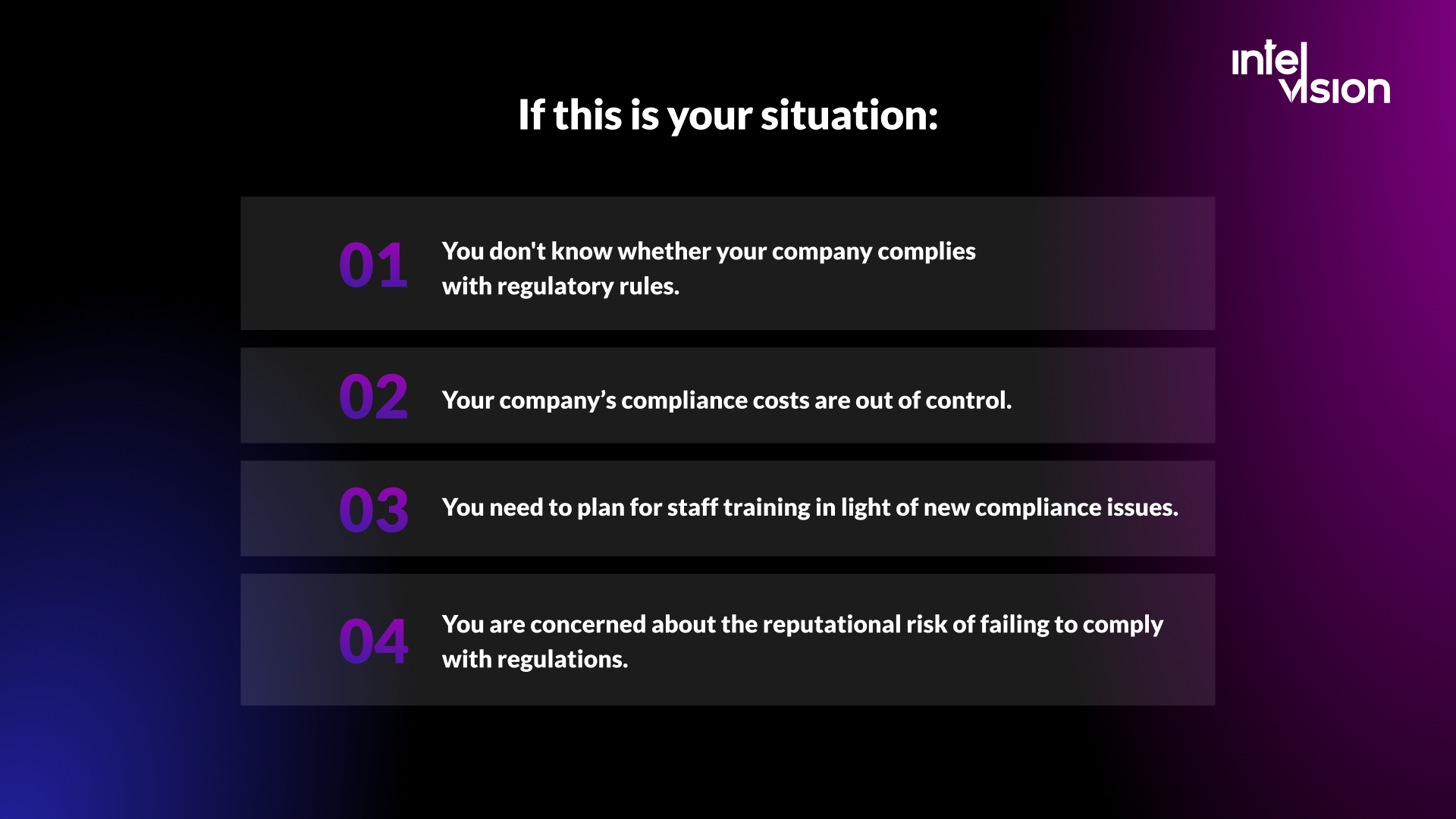

If this is your situation:

- You don’t know whether your company complies with regulatory rules.

- Your company’s compliance costs are out of control.

- You need to plan for staff training in light of new compliance issues.

- You are concerned about the reputational risk of failing to comply with regulations.

Contact us and bring Intelvision on board to spice your vision with technology! Our dedicated software development team specializes in developing regulatory compliance management software, auditing, and risk assessment tools. You can increase your business resilience using regulatory compliance software. It provides prompt risk detection, automates processes and decreases execution time, and connects teams and stakeholders by creating a collaborative environment for evidence gathering and risk assessment.

Regulatory software has a modern approach to auditing and stays in tune with the ever-changing risks in the business world. We create products that minimize costs and disruptions in your business, freeing up management time in the process.

In a Nutshell: the Key Regulatory Compliance Software Trends

The growing interest in regulatory compliance software as well as for regulatory compliance software companies has become an expanding demand for big data, cloud computing, and machine learning algorithms which are being used to heavily regulate businesses through computerized risk management procedures. We’ve analyzed the regulatory software trends which can be mass-adopted by companies around the world shortly.

Rise of ESG

The growing concern of global climate change has made Environmental, Social, and Governance (ESG) related finance a trending topic. As more governments are taking action to shift financial flows to more sustainable economic activities, regulatory software will play a crucial role in supporting the transition. Financial institutions are adapting to reporting these procedures in preparation for more innovative regulatory reporting software and streamlining their process.

KYC and Financial Crime

As more citizens are conducting their financial business online, Knowing Your Customer (KYC) will be critical for companies to avoid issues of financial crime. KYC has become a trend across the financial services market—regulatory software and compliance management solutions are no different. Financial institutions will need to access real-time accurate data to ensure their customer’s potential risk to threats. The transition to automated Knowing Your Customer services will be a big trend throughout the year.

Cryptocurrency Communications

There has been an increased focus on cryptocurrency regulation as there have been threats from tokens with unregistered securities, leaving the prices of crypto open to manipulation. The company BitMEX paid $100 million for failing to comply with US anti-money laundering laws. With a growing scale of fines and regulation within the crypto markets, making crypto communications a rising trend in regulatory reporting software for 2022.

Are you looking for a reliable software solutions developer who will help you with IT services? Talk to our experts about your business goals and plans. Using just the right tools—and the right people—we will set you on a trajectory for success with custom regulatory reporting software. Intelvision’s specialists can also provide cost-effective support for as long as you need. We’ve partnered with hundreds of companies from the US, Canada, the UK, Israel, Arab Emirates, and Australia over the past 4+ years to boost development capabilities. Let’s collaborate!

Protect your company! The regulatory requirements are there for a reason—they help protect your business, employees, and customers. Compliance with regulations benefits your company as well as internal and external individuals.