Regtech in Banking: Why it’s Important

What is RegTech in Banking: $115 Billion New Market for Financial Companies

In the first quarter of 2021, FinTech companies around the world raised $22.8 billion. It is twice as much as at the end of 2020. The reason for this growth is innovation in financial technology.

One of the most significant technologies that have appeared in the financial sector over the past 15 years is RegTech. A new study from Juniper Research has found that spending on Regtech platforms will exceed $115 billion by 2023. The global RegTech market is also expected to grow at a compound annual growth rate (CAGR) of 21.27% from 2019 to 2026.

What the heck is RegTech in banking, why is it a new disruption in the financial services space, and how is it helping firms better understand and manage their risks? We will take a look at these questions in the following article.

What is RegTech in Banking

RegTech (Regulatory Technology) is a technology that helps companies comply with the rules and requirements of regulators. In some areas, there are a lot of laws and new ones appear all the time. RegTech helps not to get lost in this flow of information—with the help of big data, cloud computing, artificial intelligence, and machine learning.

The main functions of RegTech are regulatory monitoring, reporting, risk management, and compliance. RegTech in banking empowers companies to better identify and mitigate risks, reduce costs and free up resources.

What is new and exciting about the RegTech system? Here are some of the key characteristics of the technology:

- Agility—cluttered and intertwined datasets can be de-coupled and organized through ETL (Extract, Transfer Load) technologies.

- Speed—reports can be configured and generated quickly.

- Integration—short timeframes to get the solution up and running.

- Analytics—financial RegTech uses analytic tools to intelligently mine existing big data datasets and unlock their true potential (using the same data for multiple purposes).

The Ultimate History of RegTech in Banking

It all started in 2007 when the US was hit by the financial crisis. Many blamed the problems on regulators who had little control over the banks. They began to give loans to everyone, which led to the collapse. After that, the Federal Reserve Bank, together with the US Treasury, reshaped the financial sector anew and declared many new laws in a short time. IBM estimates that regulators declare at least 20.000 new regulations a year. The complete set of rules and regulations exceeded 300 million pages in 2020.

Banks had to dramatically increase spending on lawyers, consultants, and software developers to keep up with these changes. The budget for these services for CITI alone is about $3.4 billion per year. In total, according to the American Banking Association, banks in the US alone spend about $70 billion a year on this item of expenditure.

The very concept of financial RegTech appeared only in 2015 when venture capital joined the financing of startups in this area. At that moment, the previously popular area of online lending began to lose confidence, and venture funds, actively looking for new niches for development, began to invest in RegTech in banking. In the eyes of investors, unlike many other startups that wanted to turn industries around, these became not a threat, but a reliable partner in the traditional financial system.

4 Main Benefits of RegTech Solutions in Banking Sector

The key difference between traditional solutions versus the RegTech for banking is simple—it is agility. Whilst traditional solutions are robust and designed to deliver on your specified and “locked down” requirements, they can be inflexible and require development or configuration in a proprietary language for enhancements or changes.

A further defining feature of financial RegTech is that the solutions tend to be cloud-based. That data is remotely maintained, managed, and backed up. Cloud-based digital solutions provide flexibility (customized control over data, access to and sharing of data), better performance and scalability (ability to easily add or remove service features), and higher security level (data encrypted during transmission and while at rest). Plus, you pay for what you use.

Let’s take a look at more of the benefits that have made the RegTech system so popular.

Data Validation

Companies help to automate operations for the customers’ initial verification following the rules of the regulator. Some of the providers may solve individual tasks—for example, companies are engaged in verifying the validity of identity documents or specialize in verifying customer bank accounts.

Reporting Automation

RegTech in banking fully automates the preparation of reports by applicable rules and regulations.

Data Protection

The demand for cybersecurity from financial institutions is huge. The number of cyberattacks and losses from them continues to grow: according to Forbes, last year alone, the losses from cyberattacks in the world amounted to $158 billion.

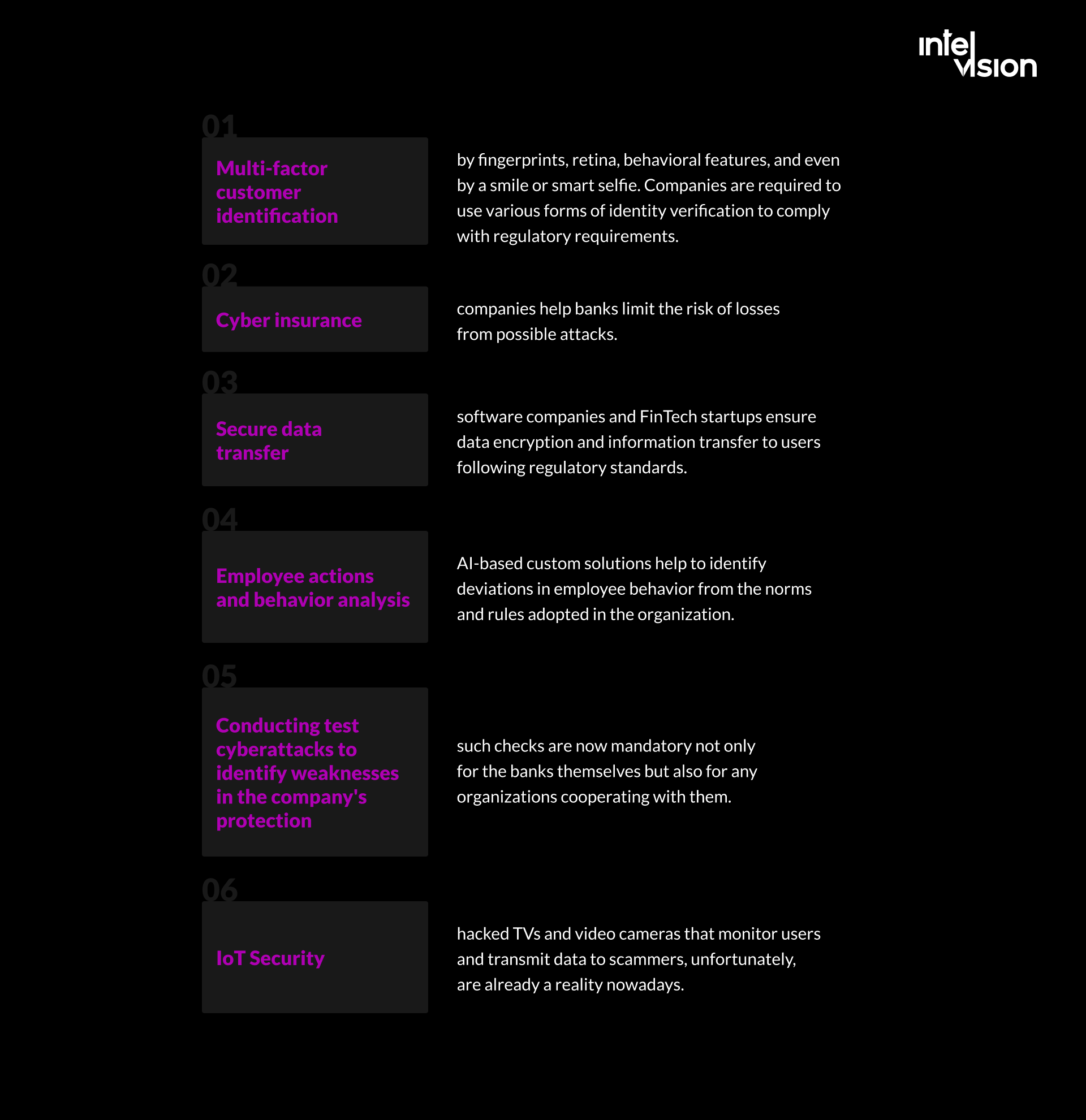

Rumors about the influence of hackers on the results of the US elections prompted regulators to pass new laws in this area. Now there are several directions:

- Multi-factor customer identification: by fingerprints, retina, behavioral features, and even by a smile or smart selfie. Companies are required to use various forms of identity verification to comply with regulatory requirements.

- Cyber insurance: companies help banks limit the risk of losses from possible attacks.

- Secure data transfer: software companies and FinTech startups ensure data encryption and information transfer to users following regulatory standards.

- Employee actions and behavior analysis: AI-based custom solutions help to identify deviations in employee behavior from the norms and rules adopted in the organization.

- Conducting test cyberattacks to identify weaknesses in the company’s protection: such checks are now mandatory not only for the banks themselves but also for any organizations cooperating with them.

- IoT Security: hacked TVs and video cameras that monitor users and transmit data to scammers, unfortunately, are already a reality nowadays.

Efficiency & Quick Response to Changes

As soon as new laws are passed, they can be loaded into the software, and it will automatically comply with them.

RegTech Key Trends Worth Watch Out for in 2022

Big data, cloud computing, and ML algorithms are being used to heavily regulate businesses through computerized risk management procedures. Here are some RegTech & financial industry trends to watch out for if you want to stay ahead of the competition.

Rise of ESG

The growing concern about global climate change has made Environmental, Social, and Governance (ESG) related finance a trending topic. As more governments are taking action to shift financial flows to more sustainable economic activities, banking RegTech will play a crucial role in supporting the transition. Financial institutions, FinTech, and RegTech companies are already preparing for more innovative regulatory technologies and streamlining their process.

KYC and Financial Crime

More and more individuals are conducting their financial business online. This is why Knowing Your Customer (KYC) will be imperative for companies to avoid issues of financial crime. KYC has become a trend across the financial services market—RegTech in banking is no different. Financial institutions will need to access real-time accurate data to ensure their customers’ potential risk to threats.

Crypto Communications

There has been an increased focus on cryptocurrency regulation as there have been threats from tokens with unregistered securities, leaving the prices of crypto open to manipulation. With a growing scale of fines and regulations within the crypto markets, making crypto communications a rising trend in RegTech solutions for the next few years.

How Intelvision Can Help to Skyrocket Your Financial Project with a Custom Software Solution

Intelvision is a quickly-growing innovative software company that connects the latest RegTech with regulatory expertise to give you smarter, more efficient ways to tackle conduct risk and compliance. Professional and reliable, that’s what clients say about our financial software development services. We bridge the most innovative development approaches with your business goals.

Only Middle+ software developers and QAs will work on the project. Our goal is to create great digital things. We are partners not only within the company, but also with our clients. Each project is led by our specialists from start to launch. Have a project? Drop us a line.

Consider these benefits:

- Increased transparency—through the integration of technology solutions, risk monitoring and management become embedded within an organization, allowing for a real-time view of its compliance status. Timely identifying risks reduces a company’s susceptibility to major unidentified issues that could result in costly remediation and regulatory fines and penalties.

- Greater cost-efficiency—automating certain compliance and risk functions allows for significant savings in personnel costs and avoids the need to source specialized skill sets in compliance and risk management.

Feel interested in technology and innovation? You can also follow us on LinkedIn and Facebook to be sure to catch our next updates on FinTech and RegTech.

Regtech in banking plays a key role in the future of risk and compliance management for financial services. Companies that implement technology will gain a competitive advantage through their ability to mitigate risk more efficiently and effectively.

![$portfolio_img_mobile['title'] $portfolio_img_mobile['alt']](https://intelvision.pro/wp-content/uploads/2021/03/Group-892-262x350.png)