ERP for Finance: Key Features and Benefits

The financial sector is one of the most stressful and risky in the world. In 2021, Brad Smith, Chief Science Officer of the stress-reducing platform meQuilibrium, surveyed 7,000 of its financial services clients. Their motivation dropped by 32% due to irregular schedules and regular overexertion.

How to increase the efficiency of financial business and reduce the workload of your company’s employees using the ERP for finance? Intelvision specialists have compiled a guide with answers to the most common questions on what is finance in ERP, what typical mistakes business owners make when implementing this software solution, as well as what other trends you should pay attention to in the financial sector.

Why Investing in Technology Is Critical

To be successful, the business must change faster than the world around you. And it has to happen faster to manage this market. Look at what’s happening with General Electric’s capitalization. It is falling, as are many other recent-ranking leaders. First of all, because their business models—like the resource economy—are becoming a thing of the past.

And then take a look at Microsoft. Outpacing Google, Amazon, and Apple, this company is now worth a trillion dollars. This is because Microsoft is creating projects for the development of artificial intelligence, and building ecosystems for small and medium-sized businesses. This is one of the ways to become a company of the future. The future is not built on the same principles as the past. The difference between the future and the ongoing present is a change in the principles that underlie decision-making. Unlock the possibilities of your business with technological solutions, including the ERP platform.

What is ERP in Finance

What does ERP stand for in finance? How often do you hear the phrase enterprise resource planning (ERP)? Everyone knows such terms: financial ERP software, SAP ERP, Microsoft Dynamics AX ERP, Oracle ERP, etc. Do you know that ERP is not a system at all, but a methodology, i.e. a set of principles?

ERP (enterprise resource planning systems) is an organizational strategy for integrating production and operations, HR management, profit tracking, financial management, fixed asset management, risk management, cash management, and inventory management, focused on continuous balancing and optimization of enterprise resources. At the same time, the ERP system is a specific software package that implements the ERP strategy.

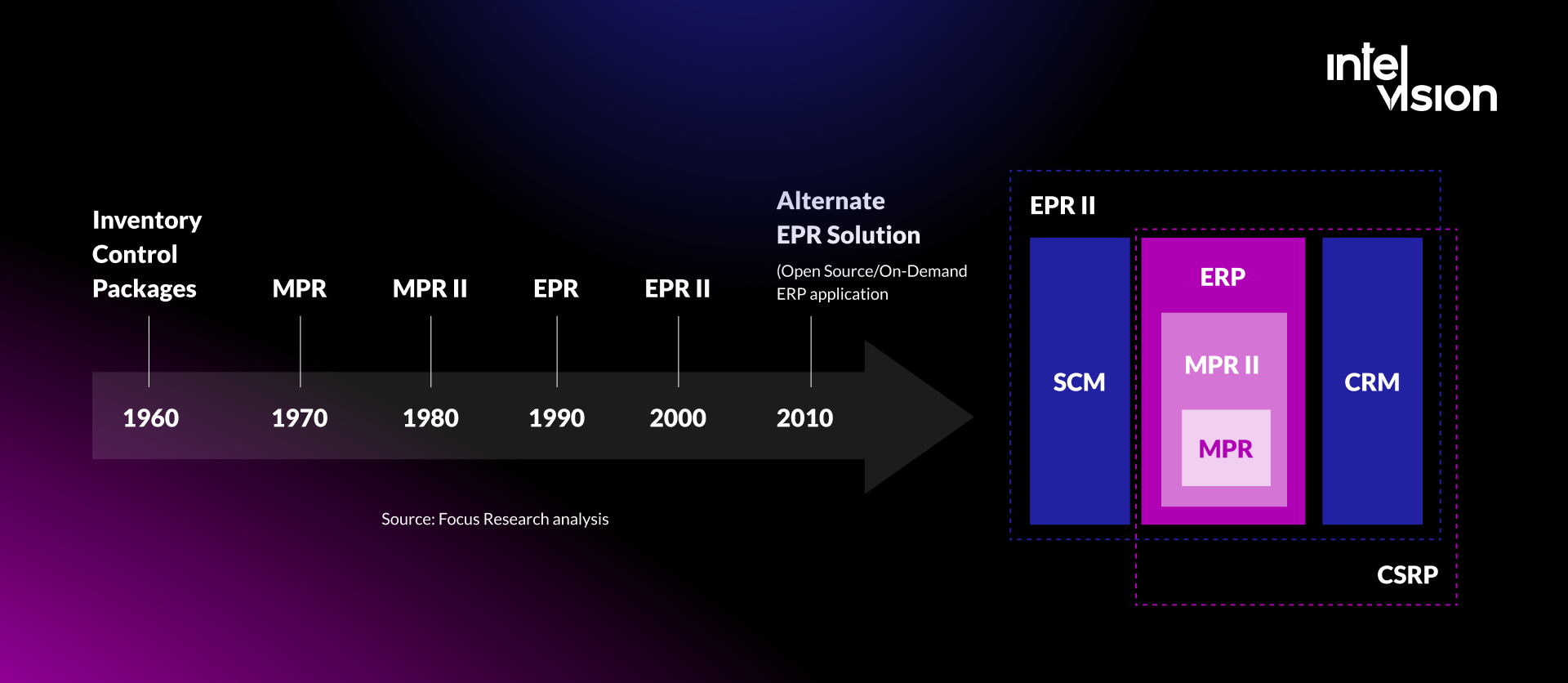

The history of ERP solutions began back in the 60s at large production enterprises. In the 2000s, the first proper ERP platform was formed. Standards, changing from decade to decade, supplemented each other. Over time, the financial management system looked more and more like a modern digital model.

ERP systems development models

How ERP System Differs from Other Similar Technologies

ERP in finance is often confused with other software solutions that help in solving certain business problems. For example, out of ignorance, an ERP solution is considered an analog of a CRM (customer relationship management) system or an alternative to accounting and tax accounting software.

The main difference between ERP software is that it allows you to manage all the resources of the enterprise, and not its parts. The financial management system:

- integrates tasks and databases of all company’s departments;

- provides a unified information environment;

- helps in solving any problems in the enterprise.

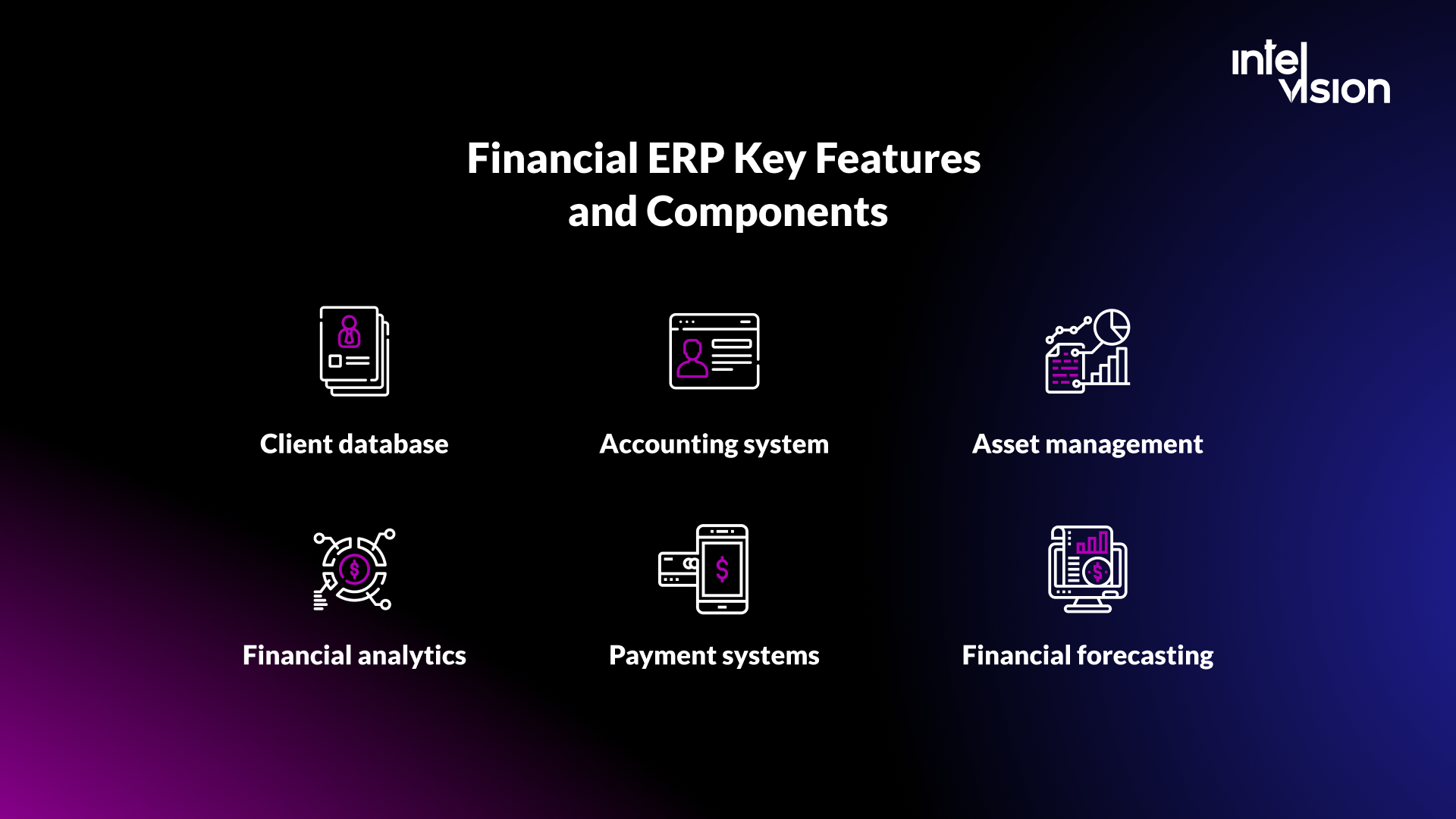

Financial ERP Key Features and Components

Features may vary for different ERP solutions. Let’s take a look at the most common of them.

Client database

You can collect data about financial transactions, balance sheets, and personal facts. Also, you can grant your staff access to this information which will be available at any time.

Accounting system

The ERP finance module will help you turn all the paperwork into online financial reports and sheets available for anyone with access. All the business processes become visible and transparent.

Asset management

With the ERP finance module, you will see the depreciation in real-time if it ever happens, and also receive advanced reports that are formed in a few seconds.

Financial analytics

You will see all the dashboards in real-time with receivables and payables data, various types of financial reports, and other important financial data units—in a user-friendly way with visuals.

Payment systems

If you provide clients with various payment systems, it will be easy to manage and make any updates. You will also make all the transactions more secure.

Financial forecasting

The ERP financial system (enterprise resource planning) will provide you with accurate forecasts that are based on reports and the current situation in your company.

ERP Financial System Benefits

In short, after the ERP solution implementation, communications in the company improve, which inevitably leads to a reduction in the number of errors and a decrease in time spent on routine operations.

Business & financial transparency

If the company has an ERP platform, information is stored on a central server, and all data is securely protected. This solution allows you to remove risks in the company’s financial information, and activities and protect it from the personal factor.

Manual labor automation

Mistakes are simply inevitable when all documents are drawn up using Microsoft Word. A typical situation in business: an employee spent a whole week compiling a report for the manager in Excel. But the report did not agree, and they searched for the notorious error for three weeks. The use of ERP solutions would significantly reduce the number of errors and allow the person to significantly increase labor productivity.

Reduced workload

Using an ERP solution allows you to enter the necessary information once and only in the unit that is its source. After that, the financial data can be used by everyone who has the appropriate authority. Due to this, the coordinated work of various departments is achieved and errors associated with the transfer of information from one app to another are significantly reduced since the entire finance department works with a single system.

Online data analysis

With the finance module in ERP software solution, the manager can analyze plans and results in real time. This is especially important for decision-making in a dynamic environment and during business growth. At the same time, time for searching for the necessary information is significantly saved, since all of it is in one place.

Who Needs the ERP System

ERP solutions should be implemented in two cases:

- When expanding business. As the company grows, planning tasks become more complex, which pushes managers to use specialized tools.

- To make valuable company information available to everyone on the team. If the main manager is not the owner, but a hired person, then in case of leaving the company, he can carry away knowledge important to the company. In this case, the ERP software can play, among other things, the role of a kind of backup copy.

However, do not be under the illusion that by implementing ERP systems, you will solve all the problems associated with business management. Smart hardware alone makes decisions only in Hollywood blockbusters. The ERP system (enterprise resource planning) implementation requires meaningfulness, and above all from the company’s management.

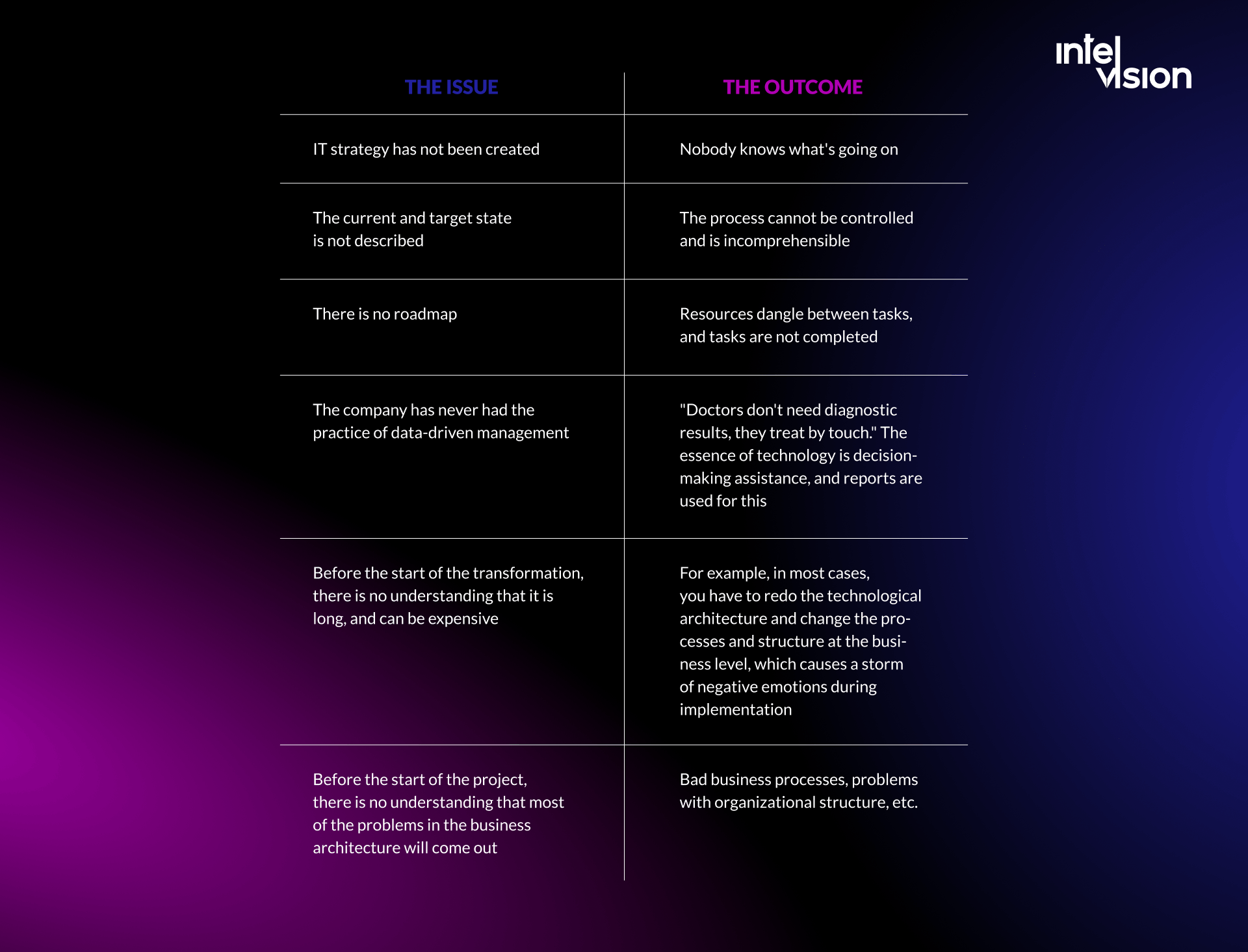

The Most Typical Problems When Implementing the ERP System

Implementing an ERP system is a complex process, which is often accompanied by a large number of issues. Let’s consider the main ones that you may encounter.

6 Other Trends and Predictions in Financial Innovation, Or What Awaits Us Tomorrow

The main drivers of 2022 are the modernization and customization of existing systems, transition to new software versions, migration of existing systems to the cloud (including using cloud ERP), building up artificial intelligence in systems, and integration with Big Data class systems.

- The financial market is changing: people care about efficiency, and banks strive to comply. If today the average application processing speed is six minutes, then tomorrow it should be three minutes.

- Payments will completely disappear from people’s minds. With the development of the Internet of things, buyers do not even have to apply for a bank card to a payment terminal. New technologies will be so advanced that goods will be able to “pay for themselves”, and artificial intelligence will be able to analyze the authenticity and security of the transaction.

- Banks will make decisions based on a person’s online behavioral profile. Financial products and tools will take into account everything—from the specifics of user interaction with Internet banking to the model of his behavior on the Internet. Financial companies will form a single vector of knowledge about the client. The information stored in such a “financial data bank” will be more important than the information that a person provides about himself.

- Banks will become even more active in using metrics. This is the only way to evaluate the effect of implementing changes to the product. The end metric should always be the change in financial performance.

- “Paper” will be even less. Complex deals will be closed in one click, and new developments will be launched in the product feed in a matter of days. Bureaucratic corporations simply will not survive in the competitive struggle.

- The bank as an institution will become more invisible to the user. Financial transactions will take place without the participation of the client. In the same way, that payment for rides in Uber works now.

How Custom ERP Software Can Boost Your Business

The greatest profit for a business is brought only by those solutions that are built around customers and cover their needs. Therefore, it is good if you develop a custom ERP platform—you will get a great opportunity to implement only those features that your business needs. If you pick up a ready-to-use solution, you will be limited in several features, or you will have to pay for those you don’t need.

Digitalization is meaningless if it doesn’t satisfy a specific human need. If the user’s problem has not been fully resolved, then no matter how technologically advanced your product turns out to be, it will not be in demand on the market.

Intelvision provides financial software development services for our clients, and we dedicate all of our efforts to finding better ways to do this. We partner with our clients to develop technology strategies, manage technology challenges and explore new solutions using the best technology available.

FAQ

How to evaluate the profit from future product implementation?

Take refinement and learn: how it reduces costs, how it increases income, or how it reduces risks. If the implementation does none of the above, then there is no profit.

What kind of specialists are needed for the ERP system implementation?

For the implementation of an ERP system (enterprise resource planning), you need: a project manager, an architect (preferably both a corporate and a solution), analysts, consultants, and developers.

How to choose the right ERP system?

Determine your functional, and non-functional requirements and limitations. Conduct a tender for three ERP systems and determine the best price offer. Don’t forget to also check out the reviews of the product or vendor that develops the ERP financial management software.

In a Nutshell

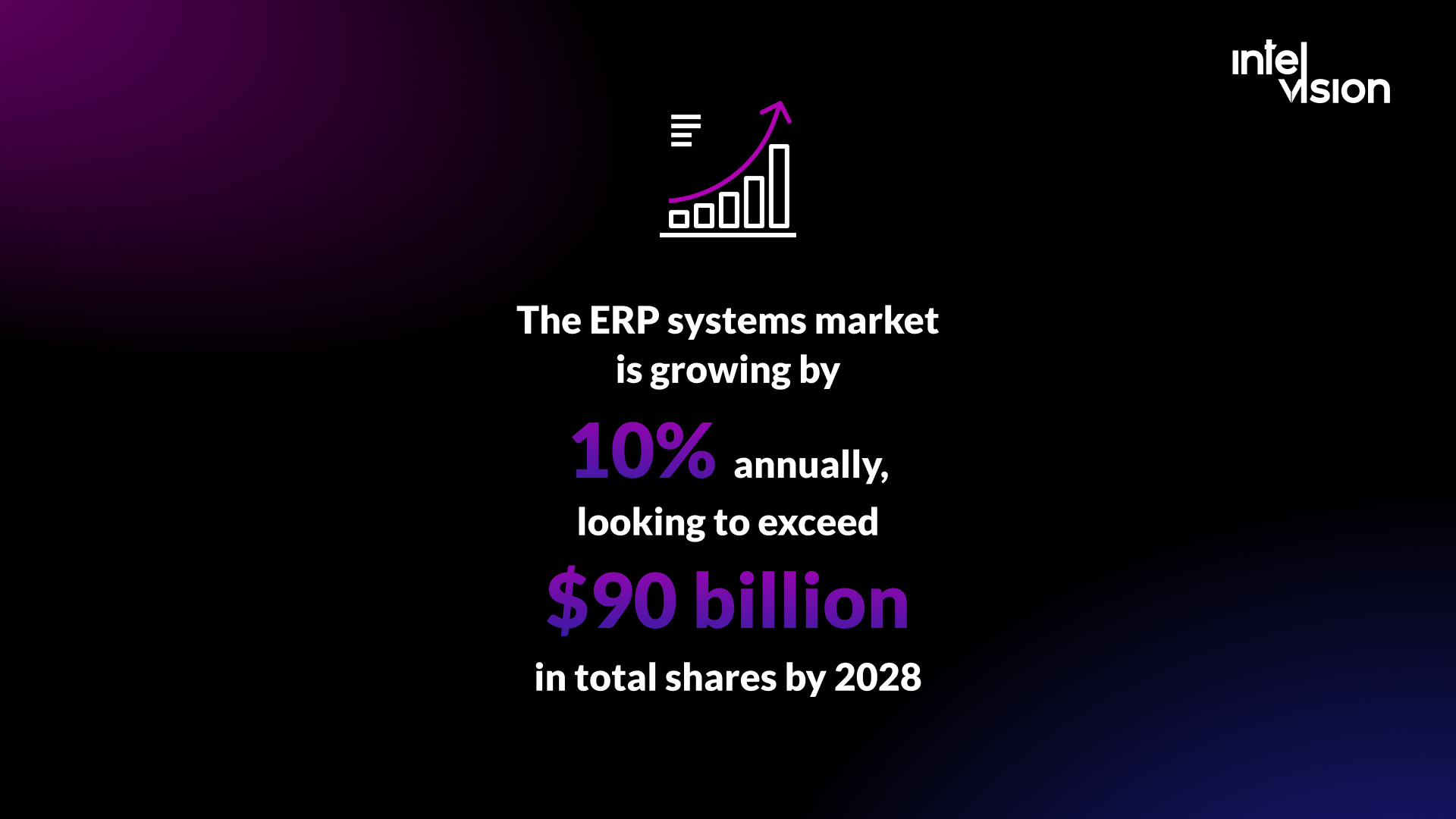

Innovations in the financial sector significantly change the structure of the company, help it work more efficiently, and win the fight against competitors. The ERP systems market is growing by 10% annually, looking to exceed $90 billion in total shares by 2028. Start transforming your business today to reap the benefits and fast ROI tomorrow.

![$portfolio_img_mobile['title'] $portfolio_img_mobile['alt']](https://intelvision.pro/wp-content/uploads/2022/11/Human-Resource-ERP-System.-Mobile-banner-264x350.png)

![$portfolio_logo_light['title'] $portfolio_logo_light['alt']](https://intelvision.pro/wp-content/uploads/2022/11/GetWorker-white-logo.png)