Construction Cost Management

Companies aim for their projects to be successful and to meet client expectations as well as their internal objectives. However, in a PMI report, 14% of the surveyed IT projects were deemed as failures, and only 57% of the projects finished within their initial budgets, with the others exceeding the goal they had set for themselves.

Cost control in construction and custom construction software development is a key part of construction management. We’ve prepared a guide on how to control costs right in your construction company.

What is Construction Cost Management?

Cost control in construction is a part of project management that combines the processes of planning, formation, control, and execution of the approved project budget. In the construction industry, the value of the final object tends to increase over time.

Force majeure, missed deadlines, lack of necessary materials, or an increase in the estimated cost of resources—each of these factors requires special attention and miscalculation at the planning stage, but not every contractor can cope with such situations within the allocated funds.

Sometimes, to meet cost standards, materials are replaced with low-quality ones without notifying the customer, or low-skilled contractors are hired who reduce the cost of work, while at the same time deteriorating quality.

Cost management in construction is provided through the implementation of the following processes during the project: cost assessment, development of the project budget, and project cost control.

Why Cost Control in Construction is Important

Cost management in construction processes provides:

- understanding of the forecasted cost of individual works, and the entire project (cost estimation process);

- a clear understanding by the PM of when, how much and for what money will be spent in the project (budget development process);

- reduction in the number of changes and deviations of the actual budget from the approved base budget (cost control process).

Construction cost control helps project managers avoid cost overruns by providing guidelines for estimates and forecasts of labor, material, and overhead costs. The purpose of a cost control plan is to help ensure construction projects are delivered on time, within scope, and on budget.

Key Features of Construction Cost Management

One of the first steps taken by a project manager during cost management in construction projects is the cost management concept development. It should contain general rules for organizing project cost management, accounting, documentation principles, and recommended methods and technologies.

All costs in the project can be divided into three types: obligations, budget costs, and actual costs.

Obligations

Obligations are planned, future costs that arise when concluding agreements, contracts, or ordering any goods or services. This usually happens in advance according to the project plan. Invoices issued by suppliers are subject to mandatory payment. However, payment can be made according to different rules at different points in time:

- after the delivery of goods and services;

- on the terms of full or partial prepayment;

- according to the policy of the organization providing goods and services, etc.

Budget costs

Budget costs are the project cost schedule. It contains information on the amount and timing of the planned costs of the project in the course of work.

Actual costs

Actual costs show the actual cash outflow of the project. The actual cost report contains information about the actual costs of the project. However, it may occur:

- during the execution of the project;

- at the time of payment;

- at the time of withdrawal of money from the account.

For many project owners, cost control is a big challenge but one they can address effectively through a cutting-edge construction cost management solution.

How to Control Plans to Get Them Done & Automate Cost Management

It is important to be able to maintain a stable cash flow. However, nowadays it becomes more and more difficult to do this because sales and margins are falling, suppliers are reducing delays, banks raising rates, and requiring collateral and credit history. How to make sure that a growing business doesn’t have problems with finances and control of funds? We’ve prepared basic tips:

- Separate personal and business finances. It often happens that a business owner takes money from a company when he needs it. This leads to liquidity problems—a lack of cash in the business and, of course, makes it much more difficult to control costs. You can withdraw money from a business under two conditions: there is a profit in the business, which is confirmed by accounting results, and second, there is money to pay dividends.

- Do financial planning. The owner is so involved in day-to-day operations, problem-solving, and order fulfillment that he doesn’t have time to look at the business from above. Many entrepreneurs do not plan their cash flow and therefore run the risk of falling into a cash gap or not meeting the working capital needs of a growing business. Knowing in advance how much money will be needed, when and for what, the entrepreneur will be able to establish a relationship with a bank or private lender. The bank will need some time for verification: confirmation of collateral and analysis of financial statements. Good planning increases resilience to market crises, promotes a regular supply of materials, and increases the likelihood that the company will be able to capture the best opportunities that arise in the market.

- Do not “eat” the entire possible budget. People will eat whatever food is put on their plate, even if there is too much of it. This has been proven by many studies. The same thing happens with the budget. Departments often don’t use all the money for specific items and transfer it to others. You can’t do that. If you’ve budgeted a specific amount, stay within it. You’ve spent less? This is normal, do not use the rest on other items.

- Use agile budgeting. It is the process of creating budgets for each scenario. When you see that you are going over budget, analyze why this is happening from an operational point of view, and make changes.

- Automate financial management. Excel tables were replaced by accounting automation systems—1C, SAP, Quickbooks (USA), and others. Medium and large companies are moving to ERP systems, the key module of which is financial management. By strengthening these solutions with CRM systems, you will be able to track the status of work, and the movement of goods and money, keep records of finances, labor resources, tangible and intangible assets, and store this data in a single accounting database.

What Is Construction Cost Management Software?

Construction cost control is impossible with simple spreadsheets unless you’re working on a very small project. Otherwise, you need construction cost management software.

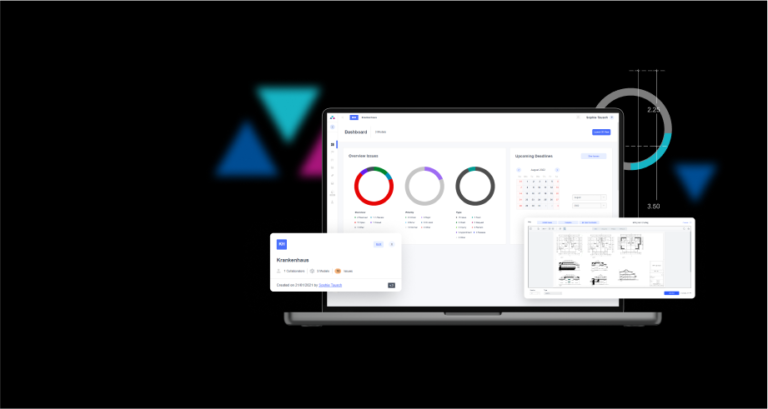

It is a solution that helps you keep up with finances, generates construction daily reports, assists you with construction planning and scheduling, streamlines construction workflow, and does a host of other tasks that construction managers need.

How Custom Construction Cost Management Solution May Help to Manage Cost & Schedule

Construction costs don’t have to spiral out of control. Construction cost management software can rein in costs, improve visibility and stay on top of every aspect of the project from beginning to end.

Our experts specialize in developing solutions that help construction project managers to monitor events, monitor cash-flow burn rate, track how the budget is being spent, and mine the data from previous construction projects to estimate future costs accurately. The software can integrate with a project owner’s accounting system to pull actual costs in directly from accounting solutions or enterprise resource planning systems, giving project managers everything they need to control costs and deliver on-budget projects without lots of spreadsheets.

Our digital solutions can cover all phases of the project life cycle, including capital planning, design, procurement and bidding, construction, and facility operations. We can also design the right construction cost management process that can save money and make construction projects more efficient.

Construction project owners need program management that is built for their businesses. Intelvision provides custom features to manage end-to-end project costs from capital planning through estimate through construction baseline and changes and to keep construction project managers on top of cost management for the life of each project.

To Sum Things Up…

If you find that every project ends with costs being way higher than what you planned at the outset, it is the right time to do a complete overhaul of your construction cost control. Explore our projects, and contact us to start reaching your business goals effectively, take your company to a new level and overtake your main competitors. Using just the right tools—and the right people to wield them—we will set you on a trajectory for success.

![$portfolio_img_mobile['title'] $portfolio_img_mobile['alt']](https://intelvision.pro/wp-content/uploads/2021/03/Group-892-262x350.png)